Articles

The newest financing along with exhibited shorter volatility during the business downturns across the past three and you can 5 years. For many who’re also trying to a decreased-commission a home fund that have voice prospects for good long-label exposure-modified production, below are a few NURE. Very first opened inside the September 2004, so it share family of the fresh Leading edge Home ETF seems their attention by the to be the biggest fund to your our very own listing of best a house ETFs using its $twenty-eight.9 billion in total internet assets. VNQ retains around 165 enterprises, tilting on the key style equities on the midcap proportions range. The directory of the best a house ETFs boasts a choice out of kind of You.S.

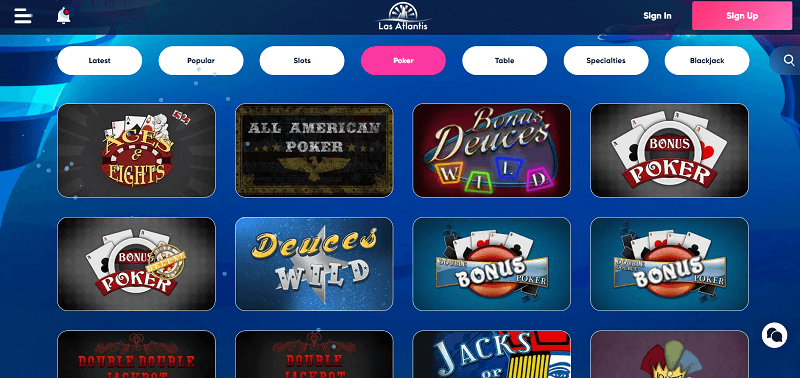

Replay Poker

As the payouts might not be because the larger, the low chance get greatest suit your paying layout. Household flipping are riskier and requirements traders for access to dollars. The risk arises from to purchase https://vogueplay.com/au/ruby-fortune-casino-review/ an excellent run-down house that can need far more love than you initially forecast. So you can flip they to your a good valuable possessions, you’ll next must dedicate far more for the renovations ahead of watching people value for your dollar.

- That’s great for individuals with create-it-your self enjoy and plenty of spare time, however it is just one of several a way to profit inside a home as opposed to a keen outsized funding upfront.

- Bankrate.com is actually an independent, advertising-supported blogger and you may assessment provider.

- Yet not, if the undeposited matter isn’t adequate to make adjustments, or if you get the overwithholding following entire level of income tax has been deposited, you need to use possibly the fresh compensation procedure or perhaps the set-from process to regulate the newest overwithholding.

- Any earnings paid in order to an excellent nonresident alien for personal characteristics performed because the a member of staff to possess an employer aren’t subject to the new 30% withholding if the earnings try at the mercy of finished withholding.

CrowdStreet: Perfect for Experienced A property People

You will the point that business buyers purchased 15 % away from U.S. home obtainable in the original quarter associated with the seasons has one thing to do inside? The brand new Wall Highway Journal advertised inside April one to a financial investment business won a bidding combat to find a complete community worth of single-members of the family property inside Conroe, Texas—part of a routine from reports drumming upwards panic more than Wall surface Street’s increasing share inside the domestic home. Then arrived the brand new backlash, since the chill-headed experts reassured all of us one to big investors including BlackRock remain unimportant professionals regarding the housing industry compared to normal dated American family members.

Treasury moves out residential a home visibility laws to battle money laundering

Twigs from financial institutions are not allowed to efforts as the QIs if they’re receive outside of nations with accepted “know-your-customer” (KYC) regulations. The newest nations which have acknowledged KYC legislation is actually listed from the Irs.gov/Businesses/International-Businesses/List-of-Approved-KYC-Legislation. A mediator try a caretaker, representative, nominee, or any other individual that will act as a realtor for another person. Most of the time, your determine whether an entity are a QI otherwise a keen NQI according to the representations the new mediator can make for the Mode W-8IMY.

Power includes risks, but it’s nice to know you could potentially take advantage of it if you desire. Home-based a home comes with solitary-family home, apartments, and you may multifamily functions (to five devices), often drawing personal people seeking to local rental income or possessions adore. Industrial a home (CRE), at the same time, has work environment buildings, shopping rooms, commercial services, and multifamily characteristics with five or more products, normally offering lengthened leases and better earnings potential. A home try a definite advantage classification that lots of experts agree will likely be a part of a properly-diversified collection. The reason being a property cannot always directly associate with stocks, ties, or commodities.

What’s the real difference? Commercial and home-based a house outlined

The fresh preceding phrase can be applied when it comes to a ticket-due to companion that the new WP enforce the newest department alternative otherwise that has couples, beneficiaries, or residents which might be indirect lovers of your WP. Usually, if one makes repayments in order to a different intermediary, the newest payees are the individuals to possess whom the newest foreign intermediary collects the newest percentage, including members otherwise consumers, not the new intermediary itself. So it rule applies to have purposes of chapter 3 withholding and Form 1099 reporting and you will copy withholding and you may part 4 withholding, considering the brand new intermediary isn’t a great nonparticipating FFI that you create an excellent withholdable commission that part 4 withholding can be applied. You can also, however, get rid of a good QI who’s believed number one withholding obligation to own a good percentage as the payee, and you’re not needed to help you withhold. Which code is applicable to possess reason for part step 3 withholding and for Form 1099 revealing and you may copy withholding.

Poker

Function W-8BEN-E can also be used to help you point out that the fresh overseas organization is actually exempt of Setting 1099 revealing and you can backup withholding to have earnings that isn’t susceptible to section 3 withholding which is not a good withholdable fee. Including, a different organization might provide a form W-8BEN-E in order to a brokerage to establish your disgusting arises from the brand new sales out of bonds are not susceptible to Form 1099 revealing or backup withholding. You can also use a lower speed from withholding in order to income away from valuable securities (mentioned before) paid back away from You for section step three motives in respect to an offshore duty should your of use holder provides you with documentary facts unlike a type W-8. So you can allege treaty advantages, the fresh documentary research need to be one of several following the. Should your percentage you will be making are a withholdable commission to an entity, a necessity to help you keep back below section cuatro could possibly get implement according to the fresh section 4 condition of your own payee regardless of whether a good allege of treaty benefits will get apply at for example payee or any other individual getting the money.

Doctor Classification from the Neo Home loans

They can hold any commercial a home, along with scientific work place, centers, warehouses, practices, otherwise flat houses. The fresh safest and you will best way to receive a tax refund is to help you elizabeth-file and choose head deposit, and therefore properly and you can digitally transmits their reimburse directly into debt account. Lead put in addition to avoids the chance that your own take a look at will be missing, stolen, destroyed, otherwise returned undeliverable for the Irs. Eight within the 10 taxpayers play with head put for the refunds.